The release of figures for heat pump installations across Europe has shown that the UK rate is bucking the downward trend, but we still have a lot of catching up to do after a slow start in converting to this greener technology and reducing our reliance on gas boilers.

Sales of heat pumps fell by an average of 23% in 13 European countries in 2024 compared to 2023, preliminary figures from the European Heat Pump Association (EHPA) reveal.

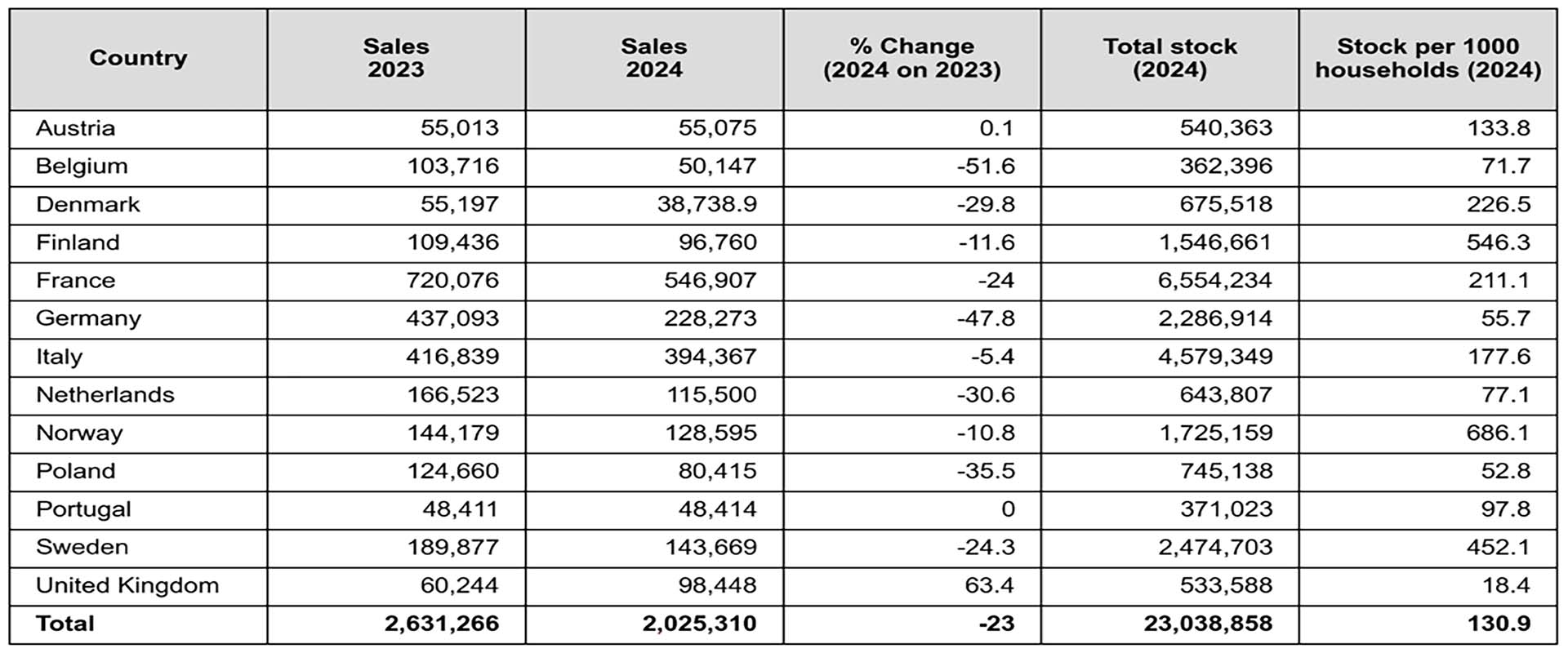

Out of the 13 countries monitored the sharpest drops were in Belgium with 52% lower sales, Germany with a 48% reduction and Poland which recorded a fall of 36%.

Only the UK bucked the trend; where heat pump sales grew by 63% in 2024 largely thanks to supportive Government funded programmes, like the boiler upgrade scheme and an increasing number of heat pumps being installed in new build housing.

Even with smaller populations Scandinavian countries are still exceeding the UK's record high rates

Lagging behind

But it also must be said that the percentage increase looks considerably better than reality as the total number of new installations was still below that achieved in countries like France, Germany and Italy.

And even after our record-breaking year with 98,000 sales in the UK, we still lag well behind our European neighbours with only 18 heat pumps installed per 1,000 homes, which puts us firmly at the bottom of the league table (see below) significantly below the average of 131 heat pump installations per 1,000 homes.

To put this further into context, the Government has set a target of installing 600,000 heat pumps annually into British homes by 2028, representing a monumental shift in manufacturing, installation resources and demand from homeowners and landlords within the space of three years.

As a first step the Government has proposed that all new housing built from 2025 onwards should include heat pumps, in place of gas or oil-fired boilers but without banning the latter from existing homes.

In the relegation zone?

In all some 2 million heat pumps were sold in 2024 in the 13 countries, which collectively make up around 85% of the European market, compared to 2.6 million in 2023. This brings the total stock to around 26 million, as householders continue to make the switch from fossil fuels to heat pumps for heating and hot water.

The table below from the EHPA provides industry data for the last 2 years.

There are three reasons given for the drop in demand across Europe according to industry experts:

- Governments have changed their support schemes for heat pumps, which has unsettled consumer confidence;

- Sluggish economies are still facing the challenges of a cost-of-living crisis since the Covid pandemic and the energy price shock following Russia’s invasion of the Ukraine; and

- The low price of subsidised gas and imports from America and elsewhere.

On top of this I would add that the Scandinavian countries are getting close to saturation point. So, it is hardly surprising that their new installations are beginning to tail off.

But even with much smaller populations they are still exceeding the record high rates being achieved domestically in the UK.

Job cuts

The downward trend on mainland Europe has also had a negative impact on employment, with manufacturers and installers slashing jobs and reducing production in Europe.

This follows the investing of billions in additional capacity in 2022 and 2023 to bolster Europe’s energy security and cutting the use of Russian gas, much of which now lies idle. This is harming the sector’s competitiveness that policy makers are so keen to bolster.

At least 4,000 jobs have been cut with over 6,000 more suffering impacts. Overall, the sector provides around 170,000 direct jobs in Europe.

In response Paul Kenny, Director General of the European Heat Pump Association commented: “The heat pump sector is down but far from out. Consumers want clean heat and comfortable homes, and they want to support European jobs and energy independence. As soon as they can see it’s possible thanks to supportive EU and national policies, and taxes which penalise fossil fuels not people, they show this by turning to heat pumps.

“We count on the EU Commission and national governments to deliver in the coming months, starting by putting heat pumps front and centre of the upcoming Clean Industrial Deal, and supporting European clean tech leadership.”

An Anglo perspective

Meanwhile Charlotte Lee who is Chief Executive of the UK’s Heat Pump Association, said: “The statistics from Europe highlight the important role of Government in providing policy certainty to support sustained heat pump market growth.”

In order to sustain and strengthen our domestic growth in installations and to encourage further investment in UK manufacturing and in growing a skilled and competent workforce, Ms Lee said there needs to be a clear, credible heat decarbonisation transition plan published by the Government which includes a detailed heat pump installation pathway, supported by policy and regulatory change.

We also need to see meaningful action being taken to reduce the price of electricity relative to gas, to support continued growth in the UK heat pump market

It is estimated that increasing the rate of heat pump adoption in the UK could create up to 55,000 new jobs, while providing a much-needed boost to the economy and improving the chances of us meeting our net zero carbon emissions targets.

A boost to the domestic heat pump sector should be linked to a programme to invest in boosting the insulation of UK homes, making them more energy efficient, while also saving considerable sums on their energy bills.

This is also a more robust and credible policy than the plans to import electricity via underwater cables from Morocco and Egypt, many thousands of miles away in north Africa, while those countries become more reliant on fossil fuels.

Problems over the security of underwater cables and pipes have been brought sharply into focus in recent years with damage to this infrastructure in the Baltic Sea and other locations around Europe with the Russian navy being accused of sabotage.

Patrick Mooney is News editor, Housing Management & Maintenance